UPGRADES

Welcome to this month’s “Upgrades” update.

It works for me in this format, but I welcome suggestions for any improvements which may make it better for everyone else, so let me know in the comments below…

INTRODUCTION

Broker upgrades, to Earnings Per Share (EPS), are something I check for pretty much every morning.

Upgrades typically come in the day, or a few days, after an “ahead” or favourable statement by a company. Quite often, thanks to Research Tree, I get to have an idea of the affect these statements will have on EPS forecasts on the day. However, not all companies provide us Private Investors with such information, so it’s usually a case of waiting to see the impact reflected in the Stockopedia forecasts. I always consider it useful to watch out for those updated forecasts on Stockopedia.

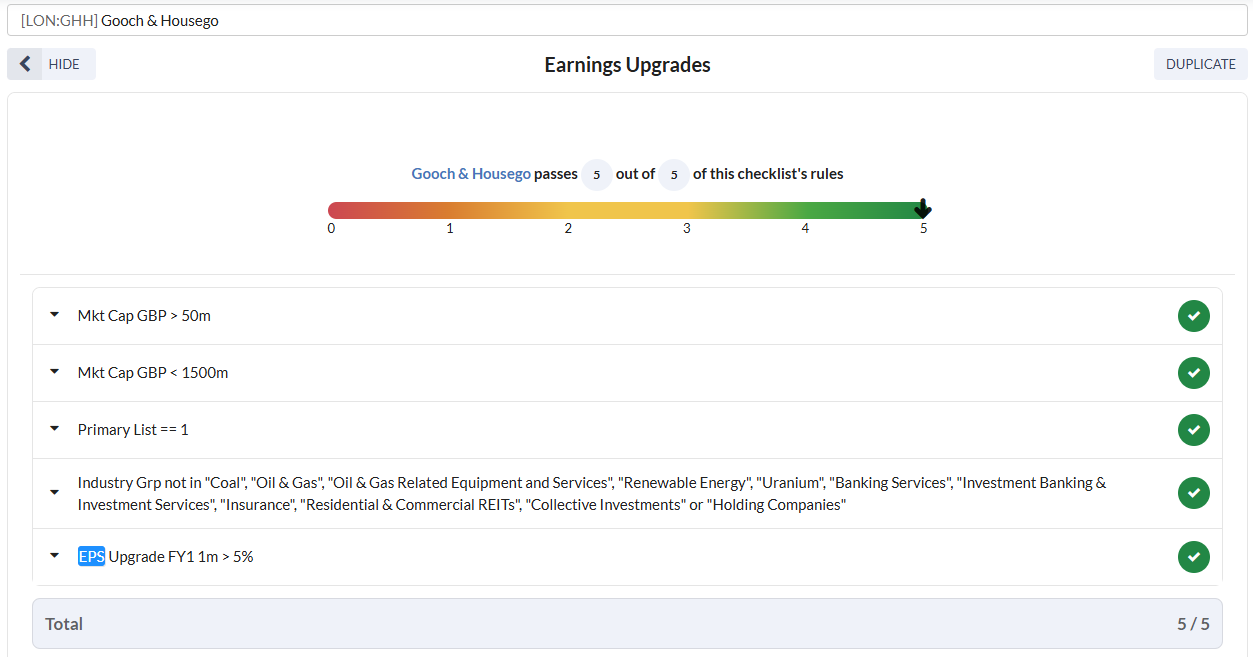

I have a simple Stockopedia screen that identifies all companies that have had a Y1 EPS upgrade greater than 5% in the past month. From this screen, I export the data into Excel and manipulate it so it looks like this.

Companies in my universe (as with “Bowls”), included in the above screen, are those with a Market Cap greater than £50m and less than £1.5bn. I exclude those in the “Residential & Commercial REITs”, “Collective Instruments” or “Holding Companies” Industry groups – Just my personal choice which leaves me with around 500 “Companies In My Universe”.

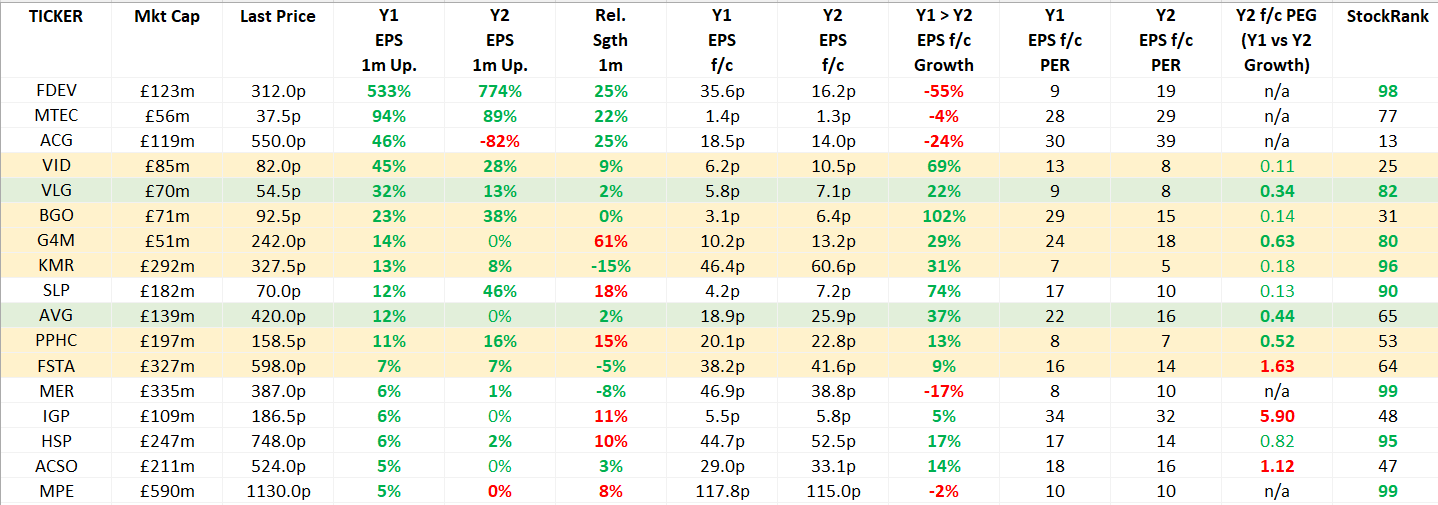

Here I can quickly identify…

Companies with a Y1 EPS upgrade greater than 5% in the past month (Dark Green)

Companies where Y2 EPS has also been upgraded in the past month (Dark Green), it’s good to see both years upgraded is it not!

The relative performance (strength) of the Share Price in the past month, Dark Green highlights those where that performance is less than the Y1 EPS upgrade (percentage)

The forecast growth from the Y1 EPS forecast to the Y2 EPS forecast, Dark Green highlights those where there is growth, it’s good to see growth is it not!

The forecast PER’s for Y1 and Y2

The Y2 PEG, which is Not Applicable (n/a) if there is no growth forecast (from Y1 EPS to Y2 EPS), Dark Red if it’s greater than 1 (no real value*), Green if between less than 1 and greater than 0.75 (some value*), Dark Green if between 0.75 and 0.25 (THE SWEET SPOT FOR VALUE*), Green if less than 0.25 (could be great value but probably indicates something is not quite right*)

* Observations based on my interpretation of PEG, which you may or may not agree with, and which is of course not applicable to all shares.

IMPORTANT NOTE – Some of the above EPS have been manually converted from their reporting currency to Sterling, so please check these where appropriate.

So, it would be nice to identify, would it not…

Companies with a Y1 EPS upgrade greater than 5% in the past month (Dark Green)

Companies where Y2 EPS has also been upgraded in the past month (Dark Green)

Companies where the relative performance (strength) of the Share Price in the past month has not yet caught up with the new forecasts (Dark Green)

Companies where growth is forecast from Y1 EPS to Y2 EPS (Dark Green)

Companies with a Y2 PEG in the “SWEET SPOT”, between 0.25 and 0.75 (Dark Green)

Well, that’s what this speadsheet gives me…

GREEN

This month two companies meet all criteria (shaded Green).

Venture Life (VLG) is “a leader in product innovation, development and commercialisation within the global consumer healthcare sector”. There’s been a bit of activity here recently, with a disposal and recent results (yesterday), which prompted upgrades. It looks way too cheap but VLG is prone to letting investors down in the past, so bear that in mind when doing your research.

Avingtrans (AVG) “designs, manufactures and supplies critical components, modules, systems and associated services to the energy, medical and industrial sectors”. Harwood are involved here and some brokers have a Sum of the Parts (SotP) value of 495p. Highly rated but forecast growth is good, worth a further look for those more familiar with the sector.

AMBER

Seven companies are shaded Amber (they meet all of the criteria except one).

Three fail on the PEG which looks suspect at <0.25, they are VID, BGO and KMR.

Videndum (VID) has a really low PEG (0.11) due to a low rating and a forecast +68% increase in Y2 EPS growth. Although Harwood have recently taken a stake, do note there were potential Going Concern issues here, last I looked.

Bango (BGO) also has a really low PEG (0.14) on a higher rating (29 falling to 15) on EPS that is forecast to double in Y2. Quite interesting if you believe the forecasts.

Kenmare Resources (KMR), Metals & Mining, Mozambique, I can’t add any more comment as it’s not an area I invest in.

Two of them, G4M and PPHC have relevant strength greater than the Y1 EPS 1m Upgrade.

Gear4music (G4M) is up 50%+ in recent weeks, outperforming the Y1 EPS upgrade. Thin margins and not sure, in such a competitive market place, it can grow into the Y1 PER of 24, which drops to 18 in Y2.

Public Policy Holding (PPHC) is a holding company on a single digit PER and c.3.5% yield. Never came across this company before, so I am in the dark here. On valuation grounds alone though, it looks worth a further look.

Lastly, Fuller Smith & Turner (FSTA) has a PEG of 1.63, which is rather high on a mid-teen PER, but it is trading below NTAV and has a 3.5%+ yield.

SUMMARY

I may hold all, some, none, of the stocks mentioned in this article.

No investment advice intended, for information only, Do Your Own Research.

Do please give feedback on this so I can make it more useful to as many of you as possible going into the new year.

Do remember, I now write for Paul three mornings a week over on his Small/Mid Caps with Paul Scott Substack, so if you want more detailed analysis every week, feel free to check it out.

Until next time!

Jon

Obviously pleased and relieved to see upgrade for AVG. The sum of parts has been at £4.95 for nearly two years I think. The spend on the Two medical companies is largely complete I hope which should improve the earnings and that’s before they start adding to revenue or get sold on. Neither Adaptix or Magnetica are priced into the sum of parts as far as I know.

G4M has given many of us the slip I suspect. Seem to remember it did very well in the pandemic, (£10!)before slipping back. With two competitors out of the game they must be cornering the market although they did not buy out either of these companies, just purchased their stock from receivers at what some perceived quite high prices. Not sure I’m going to chase it but could well go over £4 again possibly. For online they really are the go to store for instruments, disco, PA, mixers, gizmos and recording equipment . Have contributed to their revenue in the past! Very good service. Blimey they have outlets in Sweden and Germany too. their pre tax profit was about four or five times higher when they hit £10. EPS is about 12times less than then, but nav seems to have recovered a fair bit. Totally confused myself! Think I’ll stick with missed the boat on G4M, but like it a lot. This section is a great addition to the Stack. Many thanks Jon

Jon you mention margins are slim for Gm4. I’m seeing 27 percent margins. Is that slim for retail because it looks ok to me. I know shops expect better margins but they are playing the supermarket game of volume and not being beaten on price. They only have the one shop in uk, one in Sweden and one in Germany . They are predominantly an online business. The volatility is a bit scary accepting that things get over bought and oversold!

A further search has suggested that they are focusing on improving margins by cutting overheads. They are also acquiring more brand names like Premier drum kits. They have better margins than Yamaha or Fender, but they are slim by general retail standards. Looks very interesting. Will see if it falls back a bit more. Might be tempted then