Facilities by ADF (ADF) issued their Final Results for the Full Year 2022 (to end Dec-22) on 2-May-23.

This is a stock I had my eye on, on and off, since it IPO’d (in Jan-22). It kind of fell off my radar (it doesn’t seem to update the market, engage with shareholders, very often) until I noticed the Full Year 2022 results and Cenkos Broker note (on Research Tree) at the beginning of this month.

The results looked fine and these highlights caught my eye…

Revenue +13%, PBT & EPS up 50%+

Outlook (after 4 months trading this year) - Order book strong (no numbers though - Grrrr!) with current trading in line with market expectations (states that this is Revenue of £47.6m & Adjusted EBITDA of £12.3m (EBITDA was £8m in 2022)) - Meaning both are f/c to be up 50%+ on last year

I then noticed that the EPS forecast for 23E on Stockopedia were upgraded from 6.1p to 7.3p and a forecast for 24E EPS of 8.9p was introduced.

In addition to this the Cenkos Broker note (2-May-23), available on Research Tree, had forecasts of 7.6p/9.6p for 23E/24E, which are about ~10% higher than those on Stockopedia.

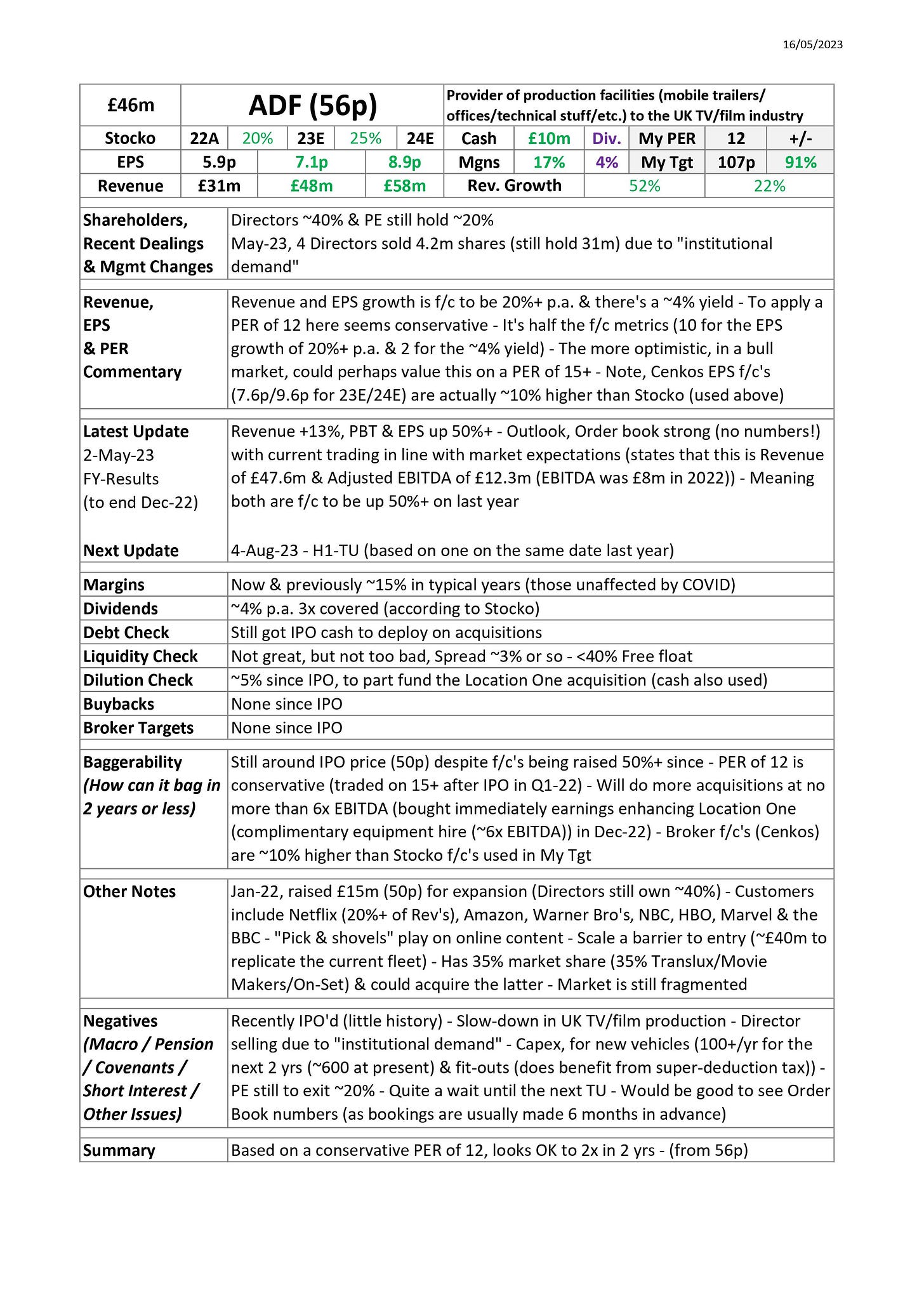

I produced my “sheet” (below) as, even on a conservative PER of 12, the value here to me just looked too compelling.

I bought in last week and at the time of publication I continue to hold this stock.

Note:

There is also a quite detailed blog post (Dec-22) by Martin Flitton here, well worth a read, even though it is now 5 months old.